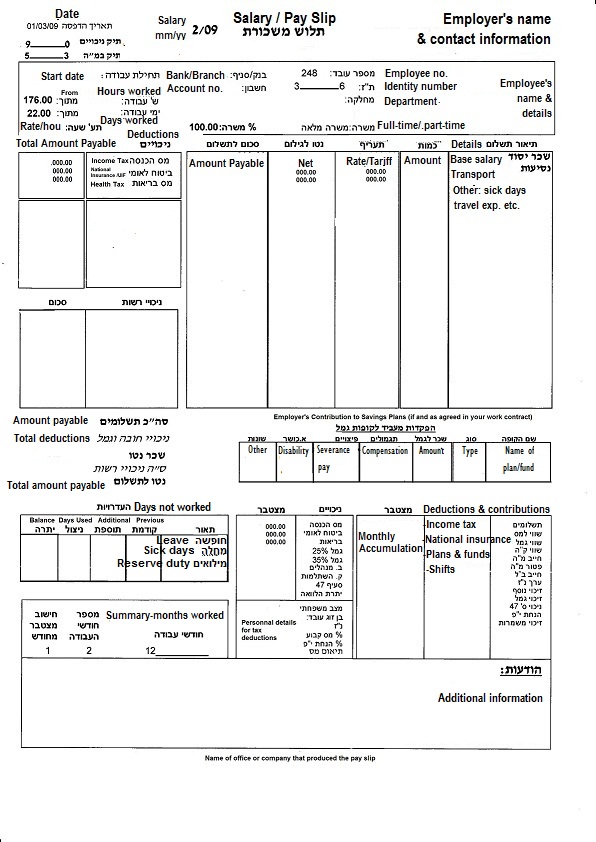

For anyone who’s ever lived in Israel, you know that one of the most perplexing things about moving here is learning to understand your salary stub. If you’re not used to seeing things like “brutto” and “netto,” it can be pretty confusing. Here’s a quick guide to understanding the Israeli salary stub.

The first thing you need to know is that the Israeli salary stub is very different from what you’re used to in the United States.

Understanding Israeli salary stubs can be confusing at first, but don’t worry – it’s actually simpler than it looks! In comparison to the United States salary stub, where taxes are taken out before you receive your monthly check, in Israel taxes are deducted after. Your salary is also listed on the top right and bottom right corners, once with all of the goverment deductions included, the other with just your take-home pay.

To navigate this strange landscape, research is essential since there are often discrepancies between what an employee’s expected take-home pay should look like and what their actual stub reads. There may be benefits or extras listed as well that you would want to investigate further. Regardless of these differences, understanding an Israeli salary stub will help you plan better for your financial future!

In Israel, your employer will withhold money from your paycheck for taxes and social security.

Working in Israel can be a great experience with employment opportunities that offer exciting challenges. But don’t forget to factor taxes and social security payments into your paycheck because your employer will take care of the deductions upfront. Depending on your salary and the rules in your field, this amount may vary significantly – so be sure to ask for a breakdown of what you’ll be getting after all the taxes are factored in. That way, you’ll have a better understanding of how much is actually going towards taxes as opposed to how much you can keep for yourself every month.

The amount of money that is withheld depends on how much you earn and whether or not you have any deductions.

Figuring out your taxes can be overwhelming, especially when you factor in withholdings. The amount that is taken out of your paycheck depends on what you earn and if you have any deductions. For example, if you make a decent chunk of money in a year but decide to itemize deductions, there may be less money withheld from your paychecks. However, if you decline the option to itemize deductions and have a higher income, then more will be taken out each pay period. It’s important to take all factors into account in order to ensure that the correct amount is being withheld from your salary.

Sections in the Israel salary stub

Imagine receiving a salary stub in Israel and being confused as to what all the information included actually means. It’s a common feeling, yet with just a little bit of knowledge you can understand each and every section detailed on your stub. First off, “gross salary” simply refers to your overall earning each month before deductions are taken out.

Deduction categories are listed next which include insurance, pension and taxes among other things depending on the job position. After these amounts have been subtracted from gross salary you then arrive at the amount of money brought home each month – this section is referred to as “net wages”.

It may seem like a lot of numbers to decipher but once you become familiar with what everything means, it doesn’t seem so complicated! Let’s learn them in detail:

a. Gross pay

Generally speaking, gross pay is what you are paid before any taxes or deductions are taken out. It’s the total amount you receive before anything else is taken away. Net pay, on the other hand, is what you take home after all deductions and taxes have been removed from your paycheck. Knowing the difference between these two concepts can mean a lot when it comes to managing your money and understanding exactly how much income you bring in each month.

b. Overtime pay

Overtime means how many hours you worked outside regular work time. These have higher rates, and we just multiply them by the amount of extra time you did.

c. Convalescence Pay

When someone is sick, disability or emergency leave is often available as a means of financial support. But what most people don’t know is that there is also something called convalescence pay. All employees that have worked at least a year have the right to this payment called Dmei Havraa. This type of payment can be provided in addition to disability leave and helps make sure that those who are recovering from an illness or injury have access to the financial resources they need.

d. 13th Month Salary

The 13th month salary is a welcome bonus for many employees. It helps to grant them financial security and some extra spending money they wouldn’t have had without it. This salary is usually the same as one month’s salary, and it’s a way for companies to express that they appreciate their staff and want them to have some extra fun during these special times. Even if it’s not an incredibly large amount, the 13th month salary makes a nice difference in many people’s lives!

e. Transportation Allowance

Transportation allowances are becoming increasingly popular among employers, and there’s no wonder why. They offer employees an important perk that goes beyond money, providing the assurance that their commuting costs will be met by the company or organization they work for. As well as making it easier to budget, transportation allowances can also have a positive impact on employee morale since they show that their employer is supportive of convenient and cost-effective commuting solutions. It’s a great way for businesses to demonstrate their commitment to their staff’s well-being. This is approximately 22.60 NIS per day or your monthly bus ticket to work.

f. Income Tax

Income tax can be a nerve-wracking experience – especially when it’s time to start filing. It’s essential to stay on top of the various tax changes, deductions, and other considerations affecting your financial situation when Tax Day comes around 21st of August. Thankfully, many resources are available to help make its complexities easier to understand and navigate.

g. National Insurance (Bituach Leumi)

This is about 5% of gross pay, paid by the employer. National insurance can be one of those draining tasks that don’t immediately seem to have a tangible benefit, but when you’re in need it can really help out. It’s easy to think of it as just something you pay once a month but the truth is that your contributions are actually part of a complex network of insurance funds designed to provide retirement pensions, unemployment benefits, and many other vital services.

h. Health Insurance

Health Insurance is also 5% of gross pay, but it’s one of the most important investments you can make in your well-being. Health insurance plans allow you to receive medical care without having to pay high out-of-pocket costs. That means when you have a medical emergency or just an annual check-up, you’re covered. As health care prices continue to rise, health insurance becomes an invaluable asset, ensuring that unexpected bills don’t break the bank.

Remember to do your research and review your coverage annually to make sure you’re getting the best plan for your needs. After all, staying healthy is worth the effort.

i. Pension

Pension plans are a great way to plan for retirement. The employer contributes 6.5% of the salary and the employee contributes 6%. It is generally paid on base salary only. By making contributions into your pension each month you can have an income when you’re older and ready to hang up your work shoes. Depending on the kind of pension plan you have, it may provide money each month, in lump-sum payments or as a combination of both. With the right understanding of how they work, pensions can provide financial flexibility during a period of life when it is needed the most.

j. Education Fund (Keren Hishtalmut)

If you’re like a lot of people, the idea of an Education Fund may sound foreign and daunting. Known as Keren Hishtalmut, this program allows both employers and employees to contribute a certain portion of the worker’s salary toward their education fund. Employees pay 2.5%, while employers can choose to give either 5% or 7.5%. It’s definitely worth looking into — with regular contributions over time, you can help set yourself up for future educational expenses.

After taxes and social security are deducted, your net pay will be deposited into your bank account.

After a hard month’s work, you finally get that paycheck in your hand. You feel excited to look into how much money you can put towards bills and other fun activities.

Keep in mind that the Israeli salary stub is just an estimate of what you’ll actually take home each month – it’s not an exact number.

When you first receive your salary stub from your employer in Israel, your initial thought may be “Wow!”, since some of those numbers may look impressive. However, it’s important to bear in mind that the amount on that paycheck won’t necessarily reflect what you’ll actually take home at the end of the month – after taxes, insurance deductions and other workplace-related expenses are accounted for. This isn’t to say that any employer is out to get you – it’s just a reality of navigating any job market! Understanding how much money you’ll actually have access to is key to budgeting and getting the most out of your salary.

If you need any help reach out to Olim Paveway!

In conclusion, understanding the Israeli salary stub and how it works is essential for anyone moving to Israel. It can be difficult to figure out all the deductions and payments that get taken out, but once you understand the system, you’ll have a much better grasp of your financial situation in Israel. Remember that this information can always change depending on the tax laws of the country, so keep up with any new changes as they occur.

If you’re unsure of what to do next and need assistance, Olim Paveway is a great resource. With years of experience in a wide array of areas in Israel, we are definitely the one to turn to when you find yourself stuck. For any help whatsoever, don’t hesitate to contact Olim Paveway at [email protected] – we are just an email away!

Moving to a new country can be intimidating and confusing, but with enough research and guidance from experts, it doesn’t have to be.

Understanding as much as possible about your finances before you make this big move will leave you feeling prepared and ready for whatever comes your way!